Tips for boosting and understanding your FICO credit score

Learn how your credit score may affect your next home loan.

Whenever you apply for a loan, lenders will want to review your credit history and credit score to assess how dependable you are when it comes to repaying money. “A high credit score shows lenders you can be trusted to repay a loan as agreed,” says Michelle Luxton, senior residential loan officer at American Savings Bank. Not only will a high credit score increase your chances of getting approved for a loan, it can also positively affect the kinds of interest rates that come with it.

Punctuality Pays

Making payments on time in a consistent fashion will have a significantly positive impact on your score—and late and missing payments are two of the biggest factors that negatively impact your credit score. “It’s important to stay within your budget, and to manage your accounts and spending well,” advises Luxton. “Consider paying your bills early to avoid late payments.”

Good Things Take Time

If your credit score is less than stellar, don’t worry! It’s never too late to start improving it. Start by tackling any outstanding delinquencies, charge offs or collections. Since your credit score is partially based on your credit history, correcting past blunders will positively affect you going forward. “It’s a process, so don’t be discouraged if after three months your score hasn’t skyrocketed by 100 points,” says Luxton. “Lenders are looking for consistent behavior, so stay the course and be patient.”

Build It Up

If you’re looking to establish credit or build it back up, consider using a few different credit cards or being added as an authorized user on a high-limit credit card and manage a low balance with it. “A prepaid or cash-secured credit card is another great way for someone with limited credit history to build their creditworthiness,” Luxton suggests. You can even build your credit by having your payment history from bills, utilities and rent reported to credit bureaus.

Busting The Three Most Common Credit Score Myths

Professional opinion provided by Michelle Luxton, senior residential loan officer at Private Lending Group of American Savings Bank.

Is my FICO score the only credit score that lenders use?

No, however…The FICO score, created by Fair Isaac Corp., is the most common score that lenders use nationwide. The other option is called VantageScore, which was created jointly by three credit reporting agencies as a competitor to the FICO score. Both scores assess a consumer’s credit file to determine that individual’s probability of paying as agreed. Within financial institutions, FICO is more widely used than VantageScore.

Do I need to carry a balance to improve my credit score?

No, you do not need to carry a credit card balance, however you do need to show usage on the card. It is a best practice to pay off your credit cards every month or as often as possible to avoid carrying a balance and paying interest.

Will raising my income improve my credit score?

No, credit is extended based on your ability to repay. While a raise in income may increase your ability to repay your outstanding debts, it does not directly raise your credit score. Your credit score is a reflection of how well you have managed your spending in the past.

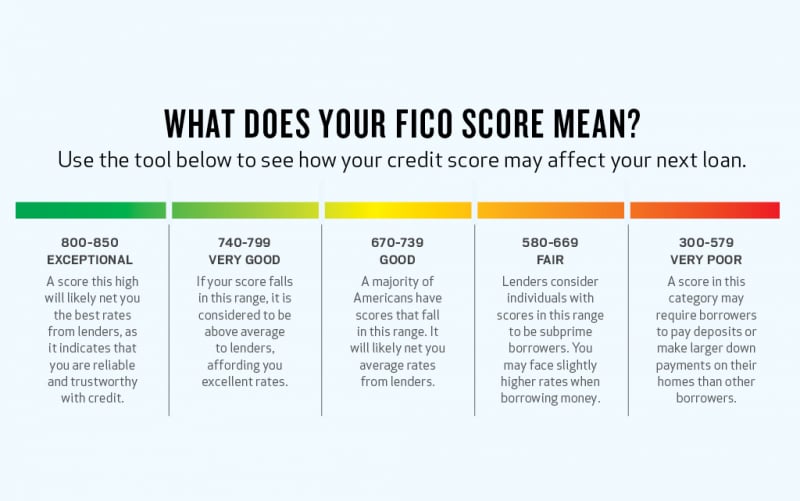

What does your FICO score mean?

Use the tool below to see how your credit score may affect your next loan.

- Tip for Couples: Joint applicants will have their individual credit scores reviewed. “The lower of the two FICO scores is typically what is used in all mortgage calculations and qualifications,” says Luxton.