Are you covered?

Learn more about how a First Insurance First Select Portfolio policy can cover your insurance needs.

[Brought to you by First Insurance Company of Hawaii]

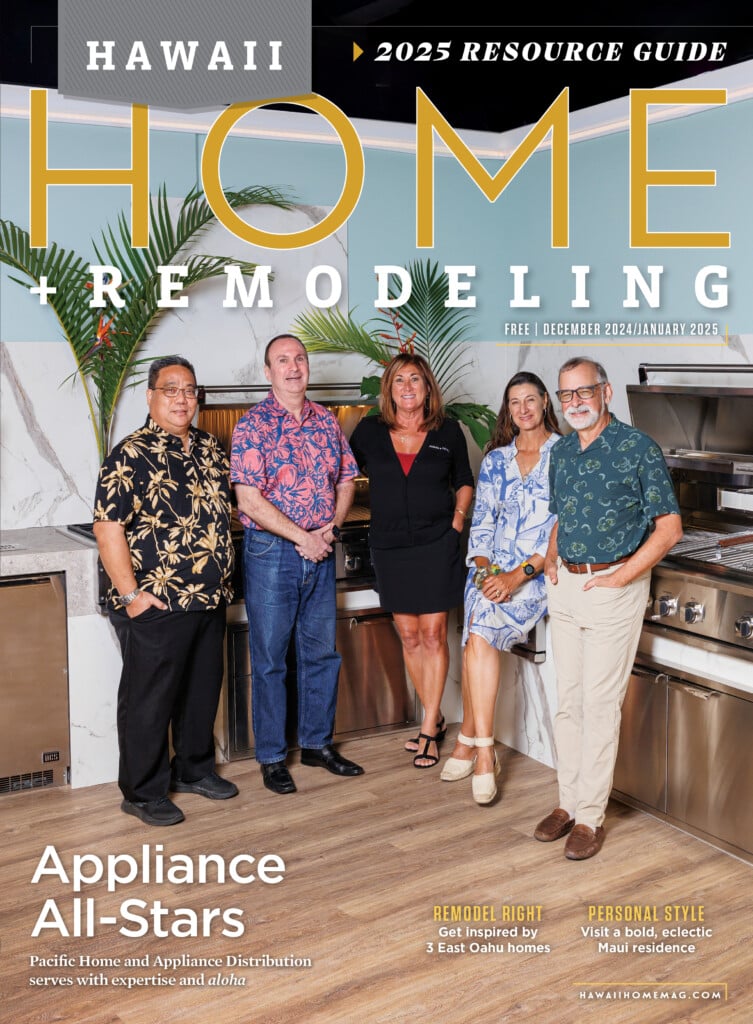

This month, our cover was destroyed by an unfortunate kitchen fire which got us thinking about insurance coverage.

A FirstSelect Portfolio package policy from First Insurance Company of Hawaii covers all your homeowner and auto insurance assets under a single policy. In this feature, we highlight the policy’s homeowner coverages.

With a first insurance FirstSelect Portfolio package policy, all your property is covered under a single blanket limit, including your dwelling, your personal property (contents), and for the loss of use of your home. By contrast, competitors’ policies would have individual limits for each property coverage, so if damage to your state-of-the-art European cabinets or premium refrigerator pushed your dwelling loss above your dwelling limit, you would be out the amount that exceeded the coverage limit. With a blanket limit, you are free to divvy the coverage amount as the loss dictates. This is especially valuable after a major loss like a quick-spreading kitchen fire.

Unlike other policies which would require you to purchase an endorsement to replace your property at today’s cost, a FirstSelect Portfolio policy automatically provides replacement cost coverage for your personal property. Replacement cost is superior to “actual cash value,” which includes a deduction for depreciation.

Unlike most competitors’ policies, your FirstSelect Portfolio package policy includes, at no additional charge, up to $500 coverage for food spoilage caused by the loss of power or mechanical failure of your refrigerator.

Under your firstselect Portfolio package policy, you can schedule your locally commissioned one-of-a-kind artworks and elect to have no deductible.

In the event your dinner guest slips on a lemon and suffers a bad leg injury, your FirstSelect Portfolio package policy combines all major homeowners coverages, including liability for personal injury, under one policy with the convenience of a single bill. Need extra liability coverage? With FirstSelect Portfolio, you also have the option to include liability Umbrella coverage with limits of up to $5 million as part of the package.

If after the fire, you can’t find your keys for your home or your auto, not to worry. Under your FirstSelect Portfolio package policy, you’re covered for lock replacement for lost or stolen keys for up to $500 for your home as well as your auto, with no deductible.

To learn more about how a First Insurance FirstSelect Portfolio policy can cover your insurance needs, visit ficoh.com/HOME.